Over the past two decades, the boundaries between the public sector and institutional investing have been blurring with the growth of sovereign investors. Sovereign wealth investors (including public pension funds, sovereign funds, and state-owned enterprises) are strong and discreet representatives of the heterogeneous matrix of institutional investors which support capitalism as we know it today. With assets amounting to $8 trillion, sovereign wealth funds (SWFs) own on average 5% of all listed equities globally, yet, little is known about them. SWFs became more prevalent in the global finance during the Great Crisis of 2008, when they saved multiple Western core financial institutions.

Since then, SWFs from the Middle East, China, Singapore or Africa, have sophisticated their investment strategies. This research program helps better understand this critical long-term investor group and the transformative role SWFs might play on central areas such as technology disruption, sustainable finance, economic development and corporate governance.

The program produces an Annual Report on Sovereign Wealth Funds, peer-reviewed papers in top academic journals and academic book chapters. Activities include an Annual Conference Agents of Change: Sovereign Wealth Funds, closed-door Seminars with regional and industry, open conversation spaces with sovereign wealth stakeholders and training programs on sovereign wealth strategies.

RESILIENCE AND GROWTH IN A NEW GLOBAL LANDSCAPE

The 2024 edition of the Sovereign Wealth Funds (SWF) report highlights the resilience of SWFs amid global geopolitical fragmentation and growing protectionism. Despite these challenges, SWFs have adopted regionally focused strategies, particularly in sectors like AI, semiconductors and telecommunications, while maintaining significant commitments to climate and sustainable development goals.

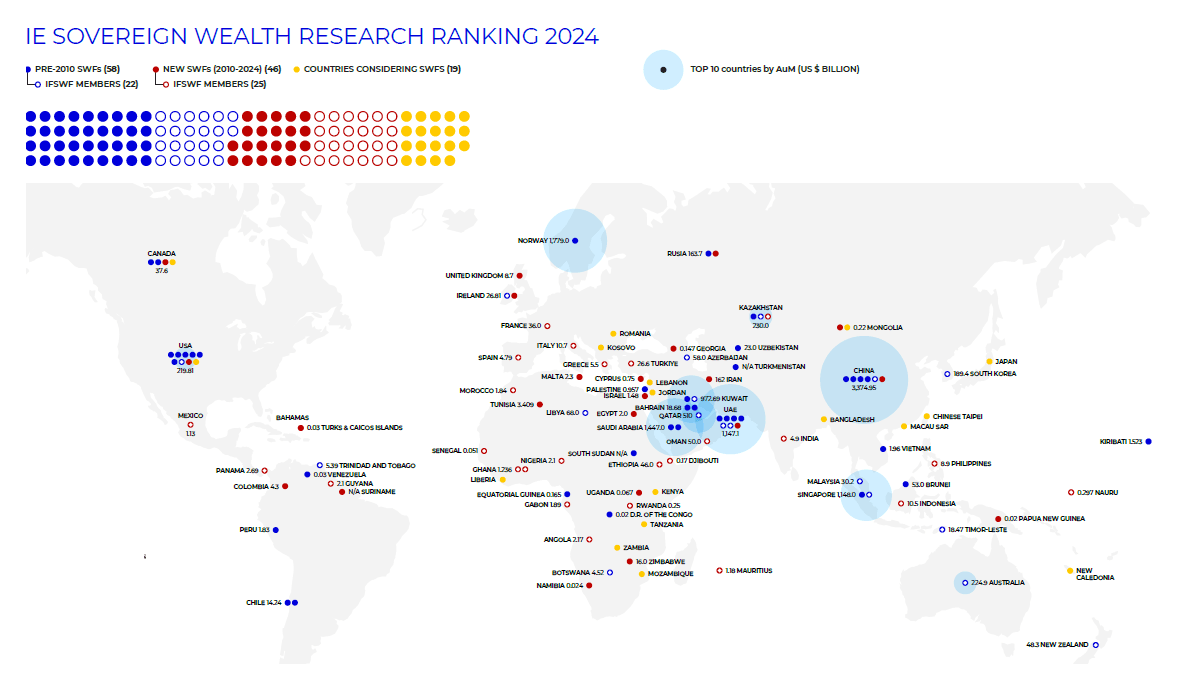

SWF assets under management reached a record $13.2 trillion in 2024, marking a 14% increase from the previous year. Norway’s Government Pension Fund Global remains the largest fund at $1.8 trillion, while Middle Eastern funds are closing the gap. Emerging markets like India are attracting increased investments, benefiting from green transition policies and strong economic performance.

The report highlights the shift in investment priorities, with healthcare, energy and industrials gaining prominence.

SWFs are playing a critical role in addressing global challenges such as the energy transition, healthcare, water scarcity and sustainable food production. Case studies, such as that of the Indonesia Investment Authority, illustrate innovative approaches to attracting foreign capital and supporting long-term economic diversification.

The report emphasizes the growing importance of blended finance and sustainable finance partnerships among SWFs and other investors to bridge the SDG funding gap. It also touches upon the Sovereign Impact Initiative (SII) by the Center for the Governance of Change at IE University, which aims at transforming the investment culture of SWFs toward impact investing.

Finally, the report looks at SWF activity in Spain. 2024 marks the second most significant year in attracting sovereign investment in the historical series, with a 140% increase compared to the previous year. Investments are focused in areas like infrastructure, including renewables and telecommunications, as well as large investments in the tourism industry.

Important developments at COFIDES (Spain's SWF) include the establishment of SOPEF II in October 2023 (with the SWF of Oman) and the development of FOCO, COFIDES' co-investment fund with a €2 billion budget to attract foreign investment (including from SWFs) in sectors linked to the green and digital transitions.

PROJECT REPORTS

2024

RESILIENCE AND GROWTH IN A NEW GLOBAL LANDSCAPE

SWF assets under management reached a record $13.2 trillion in 2024, marking a 14% increase from the previous year.

2023

INVESTING IN A DIFFERENT WORLD ORDER

The 2022-2023 period marked a historical record in the volume of assets under management by sovereign funds, which reached 11.4 trillion dollars.

2021

CHANGES AND CHALLENGES ACCELERATED BY THE COVID-19 PANDEMIC

The exponential growth of unicorns and other business giants around the world has been supported by a massive influx of institutional capital.

2020

FIGHTING THE PANDEMIC, EMBRACING CHANGE

SWFs invested in technology, services and life sciences, followed by real estate and finance.

2019

MANAGING CONTINUITY, EMBRACING CHANGE

The 2018-2019 sample included 267 transactions invested by SWFs, with a total value of approximately $139 billion.