This page is dedicated to explain in simple terms how EDEN’s investment strategy works. For more information we encourage you to visit the investor relations page, especially the end-of-year report.

EDEN uses an all-weather Investment strategy inspired from Ray Dalio. The strategy helps us achieve our three main objectives:

Eden will be here for the long-haul, as far ahead as we can see and as long as IE University will continue to exist. Therefore, legacy is our primary objective and it starts with an investment strategy that ensures a portfolio that can extend longevity to the fund.

Eden receives money from donors, which are meant for future scholarships, and it is our fiduciary duty to protect the capital we raise. Furthermore, as students we have to ensure that the investment strategy promotes risk-aversion and a conservative approach – it is the primary lesson we wish to teach and learn.

After all, Eden was created to form an exceptional learning environment where students are here to work hard and horn practical and real skills in finance. Therefore, behind any active security that flows in or out of the fund, there needs to be supporting work that comes from the student analysts, and trains them in the process.

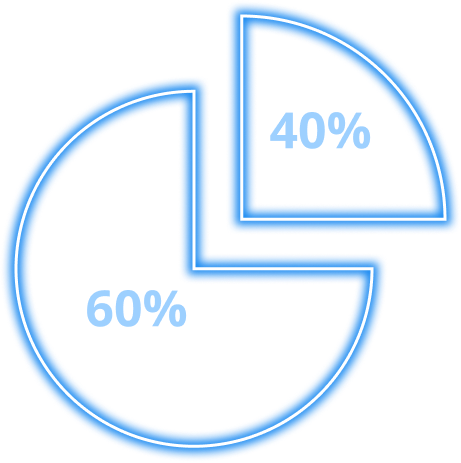

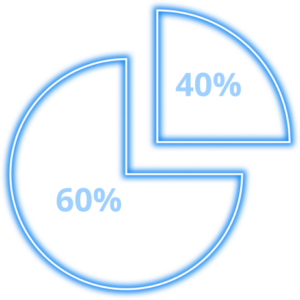

Eden is divided in two key portfolios: Core and Learn.

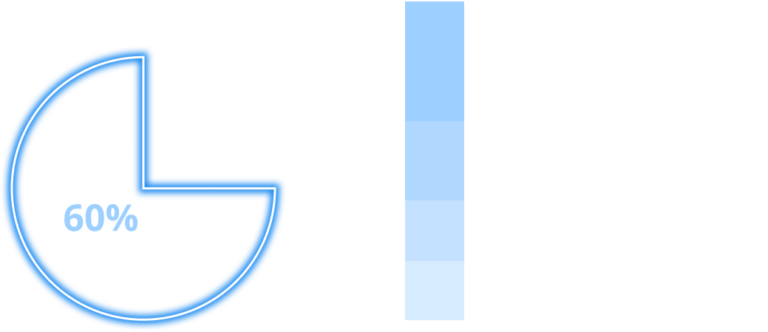

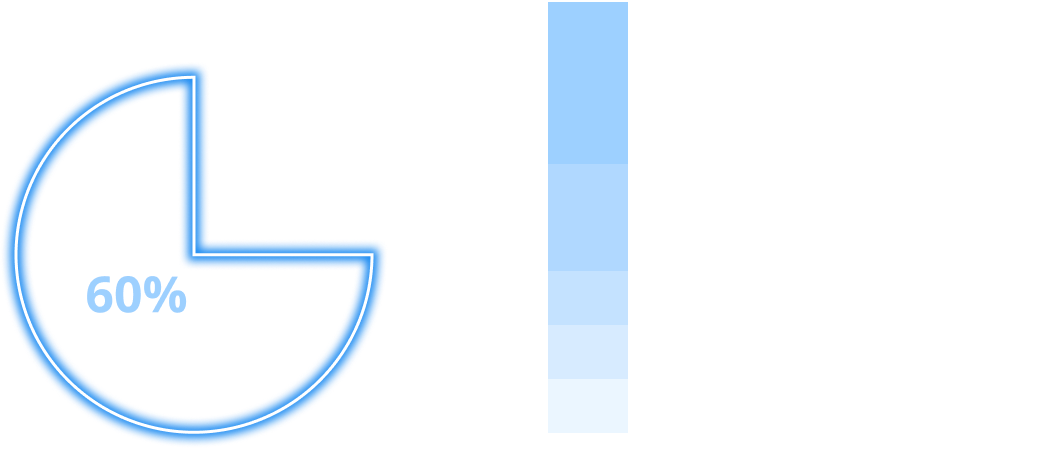

The Core portfolio accounts for 60% of EDEN and is passively managed, meaning that student involvement is not required. Every 6 months however, rebalancing occurs and new securities are purchased if funds are added to Eden’s capital base. The core portfolio is the risk-aversion pillar of Eden, holding a mix of debt and real assets (see below for more).

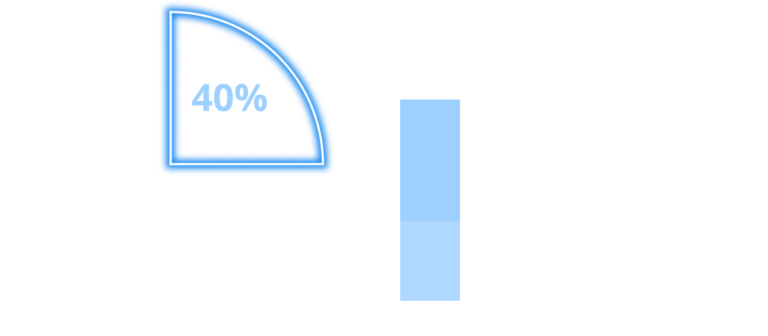

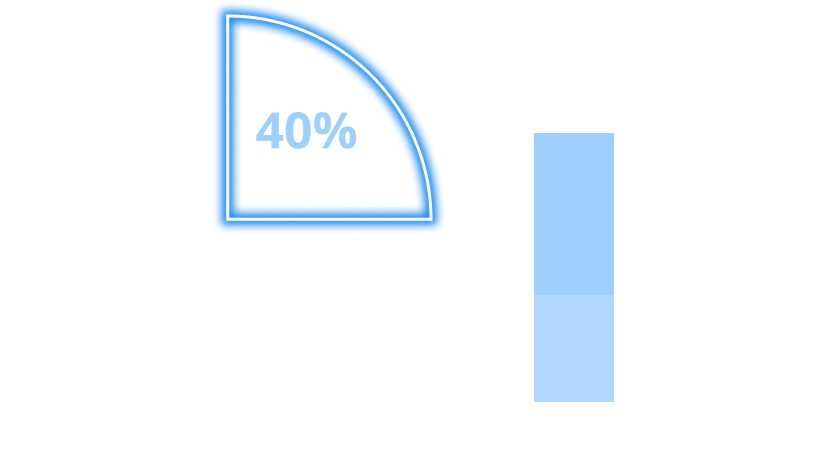

The learn portfolio accounts for 40% of EDEN and is actively managed, meaning that students run the portfolio. This portfolio is the alpha generation pillar of Eden, which is achieved through a refined investment process tailored to capitalize on students’ experience and insights.

The core portfolio holds a variety of debt instruments, as well as a pool of real assets. For debt, it is split within duration (long/short) and type (government/corporate). Real assets include gold, real estate, TIPS, and commodities.

The core portfolio is inspired from Ray Dalio’s all-weather investment strategy, which targets to perform superiorly on a risk-adjusted basis than traditional portfolios (60/40 bonds/bonds).

The learn portfolio is split within the macro portfolio (25% of EDEN) and the stocks portfolio (15% of EDEN).

The macro portfolio captures a mix of short term, medium term, and long-term macroeconomic trends and is purely allocated towards equity through index funds. The macroeconomic team is engineered to produce continuous output in the firm of industry and sector reports which can then be used as actionable investment intelligence. Commodities, leveraged products, options and derivatives are not invested in this portfolio.

The stocks portfolio is the “high-risk, high-reward” component of EDEN. Here, students pitch single-name stocks which are expected to significantly out-perform the benchmark. Students are encouraged to understand risk and have conviction in their investments, which is why the portfolio is designed to hold maximum five stocks.

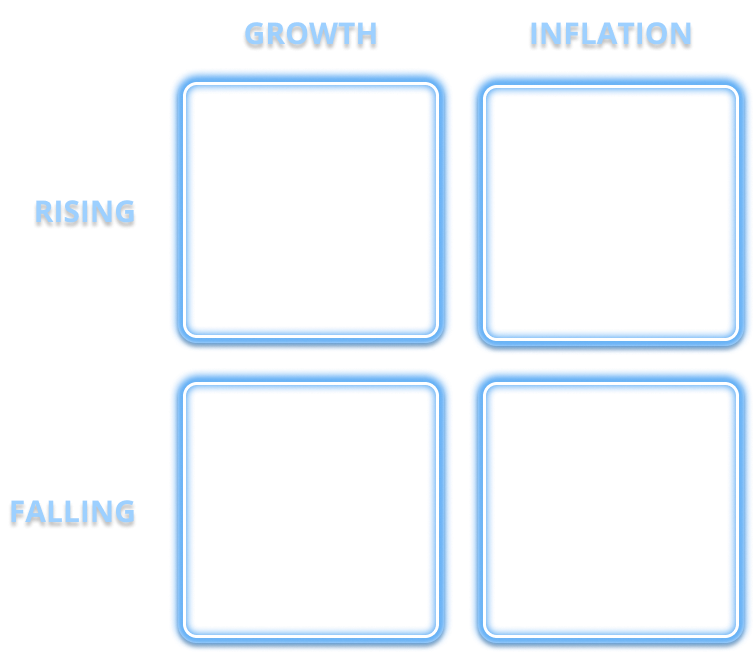

The allocation we designed (60% core and 40% learn) is supported by extensive literature in investment management, and primarily popularized by Ray Dalio.

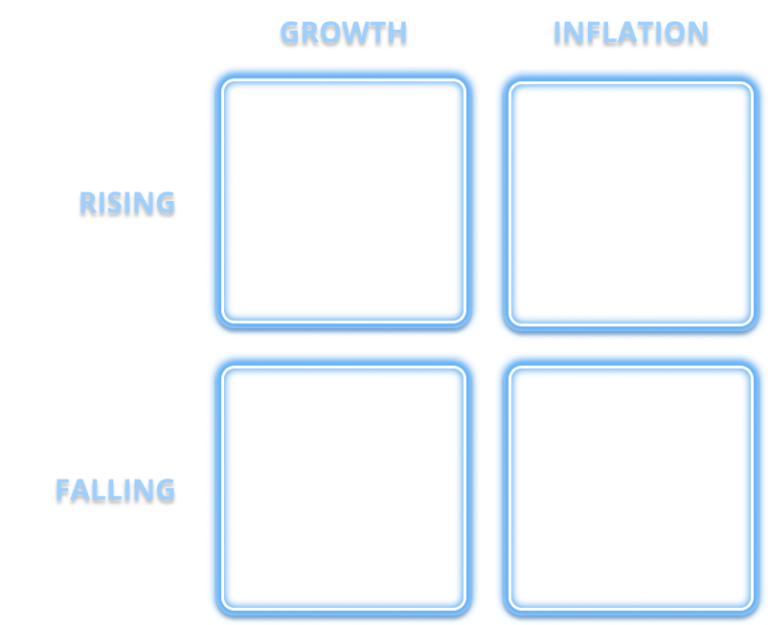

The quadrant above briefly explains the theory: by allocating the portfolio towards assets which capture equal components of macroeconomic risk, the portfolio performs better on a risk adjusted basis (than a traditional 60/40 bond/stocks portfolio).

If you are interested in learning more about this theory, we encourage you to read this article published by Ray Dalio’s Bridge Water Associates.

INQUIRY -