Being green is not a trend, it’s a survival strategy

October 3, 2022 Uncategorized

How energy firms have survived the impact of COVID-19 and the Ukraine crisis through sustainable business models

Article written by Marina Mattera, LLM at IE Law School, PhD, PMP, MSc, International Consultant

When Darwin explained that species were able to survive based on how well they adapted to the environment, he did not realize how much this would apply to other living organisms on this planet, such as organizations. During the 90s and early 2000s there was little talk of the environmental impact of business operations, or of their social aspects. However, a few visionaries who processed all the information available slowly began to adapt and make changes.

By 2010, Corporate Social Responsibility (CSR) had become a topic of discussion, and while not everyone believed in it, many started to weigh up whether it would be worth investing in. Some organizations saw the benefits of reducing their environmental impact as they were highly dependent on the availability of natural (mostly non-renewable) resources. Others realized that a good work-life balance approach, with a stimulating work environment and appealing benefits meant they could attract better talent which directly impacted on their operations across the board. Lastly, good business structure, a healthy corporate culture and solid institutions also contributed to the equation, demonstrating that environmental, social and governance (ESG) aspects added considerable value.

The earlier companies adopted these approaches, the sooner they were able to see the benefits they provided to their organizations, thus consolidating this strategy. While some were still focusing on short-term economic profit, others were envisioning the long-term effect of including ESG variables in strategic design and how these could avoid negative impacts. During the late 20th and early 21st centuries, several cases revealed that a lack of CSR compromised the mere existence of organizations. Therefore, in this delicate balance, robust and genuine commitment, as opposed to simply jumping on the CSR bandwagon, proved to be the best survival strategy. In addition, this approach improved corporate reputation, enhanced business processes, fostered continuous innovation, built a strong competitive advantage and, last but not least, enabled firms to lead change.

Green means hope, and resilience

Some industries and sectors were more inclined to lead the change, as the circumstances and events that took place during the latter years of the 20th century and the first decades of the 21st century directly affected their business models and internal processes. Such is the case of the energy industry, whose operations can cause major damage to society, the environment and the health of all living creatures. This led the organizations operating in this sector to re-evaluate their business models and product portfolios. In the European Union, where there is a particularly strong focus on mitigating climate change and improving individual wellbeing, companies gave priority to the environment, reducing their CO2 emissions, increasing the percentage of renewable energy sources, and implementing measures to counteract the negative impact of their operations.

Hence, many energy firms in Europe began to invest in renewables, modifying their product portfolio and intensifying their research and development efforts to gain a better understanding of how to mitigate climate change. However, these shifts not only impacted on CO2 emissions, they also reduced these organizations’ dependency on foreign events, given that many of the major producers of non-renewable sources of energy, such as oil and coal, are located in countries outside Europe.

What is more, by giving importance to talent and social impact, firms were also able to put in place mechanisms to attract and retain outstanding professionals. By extension, the research and development they conducted yielded better results which continued to improve business operations and enables them to find better solutions to tackle the challenges at hand. Developing and deploying new technologies that contributed to the detection of opportunities and areas of improvement in their business processes, data gathering, and knowledge generation processes was crucial to broadening their business portfolios.

By reducing their negative environmental impact and factoring in constructive social contributions, these organizations were also able to uncover an array of positive outcomes that had a domino effect. Firstly, when the 2020 pandemic struck, firms that had previously implemented CSR policies and ESG strategies found themselves better equipped to overcome the crisis. Secondly, they recovered faster (this was especially true for listed firms), showing they were more resilient. Thirdly, their corporate reputation increased. Lastly, all these effects continued to create a virtuous cycle that helped these organizations emerge successfully from this critical situation.

The answer was already in the core

Though the COVID-19 pandemic severely affected firms all over the world, and especially in Europe as one of the first regions to be hit, it was not the only adverse and unexpected circumstance that companies had to tackle. In February 2022, an armed conflict broke out between Ukraine and Russia, which directly impacted firms and supply chains across the world. Energy firms in these countries were dramatically affected, as both nations possess valuable natural resources that are used to supply energy. Multiple embargoes, bans and other restrictions made firms re-evaluate their partnerships, suppliers, and links with other stakeholders in order to comply with the new sanctions.

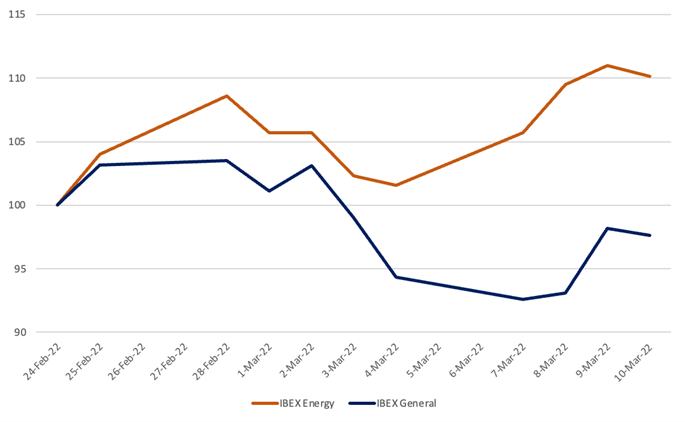

However, the energy companies which had started to transition into renewables and had already invested in research and development of new product portfolios, as well as constantly supporting and valuing their human capital, found themselves at an advantage. Their decade-long commitment to ESG increased their capacity to adapt and boosted their resilience, lowering their dependence on access to foreign commodities as well as to fluctuations in their prices – particularly oil and gas. It increased their ability to comply with sanctions and their solid corporate governance structure enabled direct, transparent dialogue, reducing the uncertain market perception about these companies. In short, as shown in the figure below which analyzes the example of the Spanish stock market, these organizations were able to outperform others during the height of the armed conflict.

IBEX 27 vs. IBEX Energy daily variation (24th Feb-March 2022)

Source: Mattera and Soto (2022)

However, this was not the only reason. As many organizations opposed the conflict, their employees were against collaborating with other stakeholders (directly or indirectly) involved in the war and the corporate culture and values of these firms were put to the test. The firms that had begun the transition into a greener product portfolio, who valued and cherished their employees and other stakeholders, and had a solid corporate governance infrastructure, did not hesitate. For these companies, the answer was already embedded in the core of their corporate culture and business model. Their green approach made them less dependent on foreign resources, and their social approach enabled them to attract brilliant talent, which helped displaced individuals.

In sum, ESG commitments provide a holistic approach to creating more sustainable business models that can overcome diverse types of adverse situations and help mitigate volatile, uncertain, complex, and ambiguous environments. Greener companies can also provide hope to displaced individuals and their organizations’ human capital can grow stronger while contributing to alleviating suffering, thus creating a virtuous cycle and having a positive impact on all stakeholders.