Trust lies under all business relations. While contracts may tie us together and can be helpful in specifying the rights and obligations of signatories in specific situations, a contract can never really cover every eventuality. Thus, at the end of the day, there is trust – and it is necessary when entering into a contractual relationship with a new counterparty. Ultimately, trust enables strangers to work together and to produce goods and services. At the global level, high levels of trust may explain why some countries have been striving economically while others are stuck in what economists call a low-trust poverty trap.

The issue of trust, or rather the lack thereof, has been prominent in the ongoing bankruptcy reorganization of Revlon. Although Revlon was founded during the Great Depression of the 1930s and should therefore be highly resilient to shocks, the US cosmetics firm has been hit very hard by the 2020 Covid-19 pandemic; it has been struggling since and eventually filed for Chapter 11 bankruptcy in June 2022. While Revlon is on the New York Stock Exchange, it is not your typical listed US firm as it has a large, well, very large shareholder: Ron Perelman who owns just over 85% of the stock. In turn, Perelman’s daughter, Debra Perelman, is Revlon’s CEO.

Revlon’s bankruptcy proceedings have been colorful to say the least. For example, Sujeet Indap of the Financial Times called the Revlon stock a meme stock, because it has been pushed to ridiculously high levels after going viral online. The price of Revlon stock initially dropped from a high of $11.66 in early January 2022 to $1.13 in June when the bankruptcy reorganization started. However, the stock price then hit a new peak of $8.89 in early August and at the time of writing it is still trading at around $5.90. This seems absurd because Revlon’s unsecured bonds are trading at around 10 cents for each dollar of face value. Note that a company will only file for bankruptcy if it can no longer meet the claims of its debtholders. Whatever money is left in the company will go to the debtholders, as their claims are senior, relative to those of the shareholders. This would then imply that Revlon’s stock price should be zero or at least close to zero.

More importantly, aside from these pricing oddities, Revlon’s minority shareholders are on the record for stating that they do not trust anyone – and this includes Ron Perelman – to speak up for them in the bankruptcy reorganization. The Revlon bankruptcy reorganization is a rare example in which the minority shareholders have become vocal, expressing their discontent. Typically, minority shareholders find it costly to be outspoken or activist – or even just routinely monitor the management of their investee firms, for example by exercising their votes at the general annual shareholders meeting (AGM).

In a recent study published in the Journal of Banking and Finance, my colleagues Peter Limbach from the University of Bielefeld and Simon Lesmeister from the University of Cologne and I investigate the relation between trust in complete strangers and shareholders’ voting behavior at the AGM. The idea of the study is simple: We expect that shareholders are less likely to exercise their votes in countries with high levels of societal trust. In turn, we expect that if they vote at the AGM, the shareholders are more likely to side with the management than vote against it.

Why do we expect these patterns? Voting requires the gathering and analyzing of information about the firm in question and then making an informed decision about whether to vote for or against the various motions at the AGM. Individual small shareholders typically have relatively modest sums of money invested in each of their investee firms, amounts that hardly justify spending much time on each firm. To that point, small shareholders tend to vote more with their feet than going through the trouble of placing an actual vote at the AGM.

In societies where trust is high, breaking that trust generates hefty social and psychological cost.

So, why do high levels of trust make shareholders less likely to participate at the AGM and at the same time increase the percentage of votes in favor of management proposals? In societies where trust is high, breaking that trust generates hefty social and psychological costs, such as shame, guilt, remorse, and ostracism. Ironically, if trust is the norm where you live, you best behave as people expect you to behave or the consequences might be dire!

Is it possible to measure whether people trust strangers? Yes, by using various waves of the World Values Survey (WVS), a survey with data that has been used by numerous other studies. There have been seven waves of the WVS so far – the first dates back to the early 1980s and the most recent one was from 2017 to 2022. The survey uses a common questionnaire across almost 100 countries. The question or more precisely the statement from the survey that is used to measure trust in a country is as follows: “Most people can be trusted” against the alternative that “you can’t be too careful in dealing with people.” The percentage of respondents who agree to the former statement is then used as a measure of trust.

Based on this most recent wave of the WVS, which is in fact consistent with earlier waves, societal trust varies greatly across the world. The country with the lowest level of trust is Zimbabwe where only 2.1% of respondents agreed that most people can be trusted. This contrasts with Denmark where a staggering 74.1% of respondents feel that most people can be trusted. In the United States, the percentage is somewhere in between the two extremes at 40.4% and Spain is similar at 41.5%. Countries with exceptionally high levels of trust include the Nordic countries and the Netherlands, which all exceed 60%. Does trust change over time? Well, the various waves of the WVS suggest that trust tends to be a relatively stable belief. For example, the Nordic countries have always ranked at the top of the league table whereas some countries, such as Colombia, have always ranked close to the bottom.

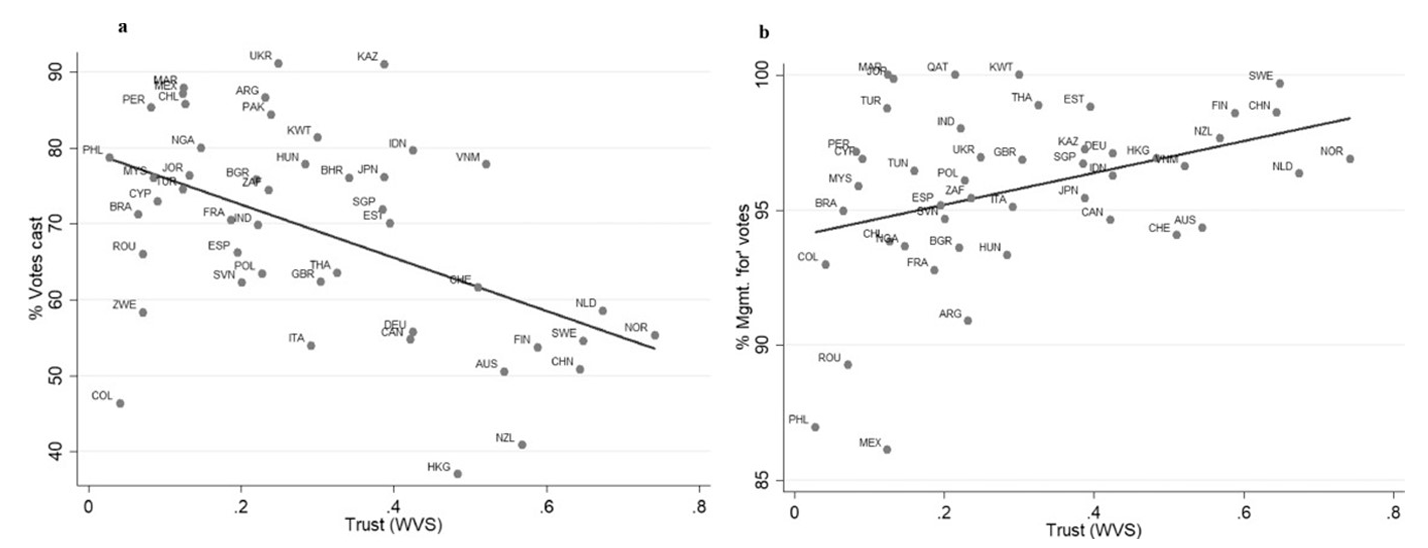

Back to shareholder voting, our study focused on the percentage of votes that are exercised at the AGM (shareholder participation) and the percentage of votes in favor of the management proposals that are tabled. It is important to note that virtually all proposals put forward at the AGM are proposed by the management, with only 1% coming from the shareholders (and we therefore exclude the latter from the study). Of the 43 countries included in the study (which includes the United States), the average percentage of votes cast is 59%, ranging from 40.8% in New Zealand to 100% in Cyprus. While the average percentage of votes in support of management proposals is high at 96%, there nevertheless is some cross-country variation with a low of 83.8% in Bulgaria and a high of 100% in Morocco and Qatar. Still, for all three countries, the number of observations is very small and drawing reliable conclusions on these countries is therefore not possible.

As per our expectations, we find a negative – or inverse – relationship between trust at the country level and the average percentage of the votes cast at AGMs. Put simply, when trust is high, as it is in Denmark, there are fewer shareholders voting at the AGM, because they feel that the management will run their investee firm taking into account shareholder interests. Furthermore, when the trust in a country is high and the shareholders do in fact vote, they commonly vote in favor of management. See the two figures below. Therefore, it is safe to say that shareholders save themselves the cost of monitoring the management of their investee firms in countries where the levels of societal trust are high.

But what happens to a company’s financial performance when a country’s high level of trust means that shareholders do not bother to closely monitor the company? It would make sense that executives might very well opt for a quiet life if they can get away with it. Our study does find support for this argument: there is a negative link between future financial performance and low levels of shareholder voting participation. (So in this way, trust begins to rub away at the very thing that created it.) However, this negative link is much less pronounced – or even absent – in countries with high levels of trust. To conclude, while managers might get away with having a quiet life, they do not choose that route in countries where trust is the norm.

When managers and the leadership team understand the trust level of the country in which they are operating and the impact it has on the actions of shareholders, they can then anticipate the likely percentage of votes a management proposal may receive at the AGM. Our study also controlled for an exhaustive list of additional country-level characteristics as well as various firm-level characteristics when explaining the voting behavior of shareholders. Regulators who want to improve minority shareholder activity at AGMs of stock-exchange listed firms should likewise be aware of how country and firm characteristics affect the level of participation.

© IE Insights.