The rise of “meme stocks”, stocks that are highly discussed on social media, during the COVID-19 pandemic shed light on the importance of social media and individual investors in the stock market. As of late, regulators including the Securities Exchange Committee (SEC) and the European Securities and Markets Authority (ESMA) have explicitly expressed concern about the risks brought by social media-driven transactions. ESMA in particular warned individual investors to be careful about misinformation spread by social media and other unregulated information sources. From the regulator’s perspective, there is indeed nothing wrong in delivering a warning to individual investors – in the words of the SEC, the purpose of regulators is to “maintain fair, orderly, and efficient markets.” However, individual investors have a different goal, which is simpler: to make money. Therefore, whether and how to pick stocks using social media is eventually an empirical question.

Information is expensive. Professional investors pay tens of thousands to buy analyst reports and subscribe to the Bloomberg/Thomason Reuters terminals. It is less likely that a normal individual investor can afford it. Traditional mass media and Google searches are common ways for these individual investors to search for information on stocks. Yet, it also brings some significant hidden costs – investors need to spend substantial time and effort to read, filter, and process information. New and inexperienced investors may shy away from the traditional information searching process: a recent study shows that information demand during the first months of the Covid-19 pandemic dropped significantly despite the fact that individual investors rushed into the market at the same time. Meanwhile, social media provides a low-cost, timely, and interactive approach for individual investors. Some social media platforms (e.g., stocktwits) also provide free and decent analyst reports. Recommendation systems used in social media make sure that social media users get the information mostly wanted, though maybe not mostly needed.

Misinformation and slant in mass media actually hurts investors more.

While the information on social media is cheaper than that on traditional information channels, is its quality necessarily worse than that in other information channels? A handful of academic studies already suggest that social media has fundamental information that is not incorporated in the traditional information sources: Social media contains the information on the popularity of a company’s product and, as such, it can predict not only the stock returns, but also the future company’s financial reports. Stock markets may not respond to a piece of information in the market but to social media that aggregates all the information.

There is no denying that social media contains misinformation. However, the question the regulator should ask is whether the information provided by mass media is better than that by social media. There was a reason that Trump used “fake news” to challenge mainstream mass media. Fake news also appears in the finance-related reports: In 2018, Bloomberg Businessweek published a news report arguing that China used a microchip to infiltrate almost 30 US companies, including Amazon and Apple. It is 2022 now. There is still no evidence supporting this argument. If this is not “fake news”, China should have microchip technology six years more advanced than the US. Another common theme of mainstream media is to slant or omit facts, either intentionally or not. On Nov 5th, 2021, Bloomberg Businessweek reported that “nearly half of Hong Kong’s reporters considering leaving”, suggesting the investment environment in Hong Kong was deteriorating, without mentioning an interesting factor that Bloomberg itself added 55 foreign employees alone in Hong Kong in 2021. More specifically for a company, mass media can report the same event using different tones. For example, “Alphabet results: Google parent company announces 20 percent revenue increase” and “Alphabet’s Q3 earnings missed the Street’s expectations by a mile” are two reports on the same event, but with two polarized sentiments. Individual investors would receive different signals to make decisions.

My point here is that we do observe misinformation in social media. However, regulated information channels (e.g., mass media) do not seem better than social media. Misinformation and slant in mass media actually hurts investors more, given that investors put more trust in it.

Whether information in social media is useful for individual investors, even after considering the factor of misinformation, is ultimately an empirical question. Information that is not always justified by the fundamental value of a company – in finance, it includes misinformation, rumors, and stale information – is called “sentiment”. It is not news that sentiment from social media can predict stock returns. It is common practice in financial markets that use big data technologies (e.g., machine learning, sentiment analysis, deep learning) to carry out high-frequency trading. The Bloomberg Terminal has an information block that provides in-time social media analyses. In fact, some mutual funds (e.g., VanEck Vectors Social Sentiment ETF) are built upon the assumption that social media is associated with stock returns.

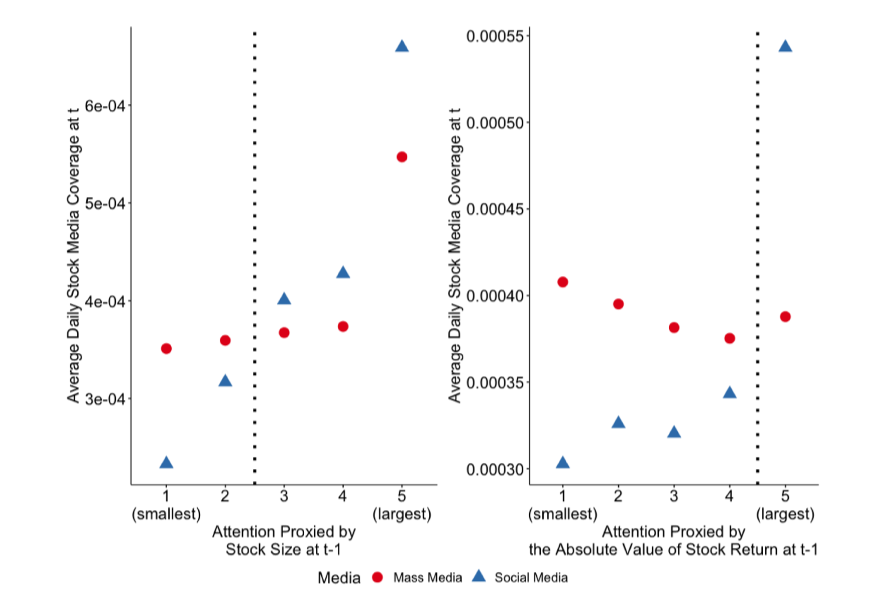

Information on social media works. But between social media and mass media, what should individual investors choose? To answer this question, we need to understand the difference between the information on social media and that in mass media. Figure 1 shows the distributions (average percentage) of social media on each stock across our attention proxies (left: size of stocks; right: absolute value of stocks). Social media posts are more skewed in some stocks, while mass media articles distribute more equally – that is, information coverage of social media is less diverse than that of mass media in the stock market. The results suggest that social media serves as an information filter – it highlights some information and downplays other information.

Figure 1: Comparison between the Distribution of social media posts and that of mass media reports (source: Dong et. al., 2022)

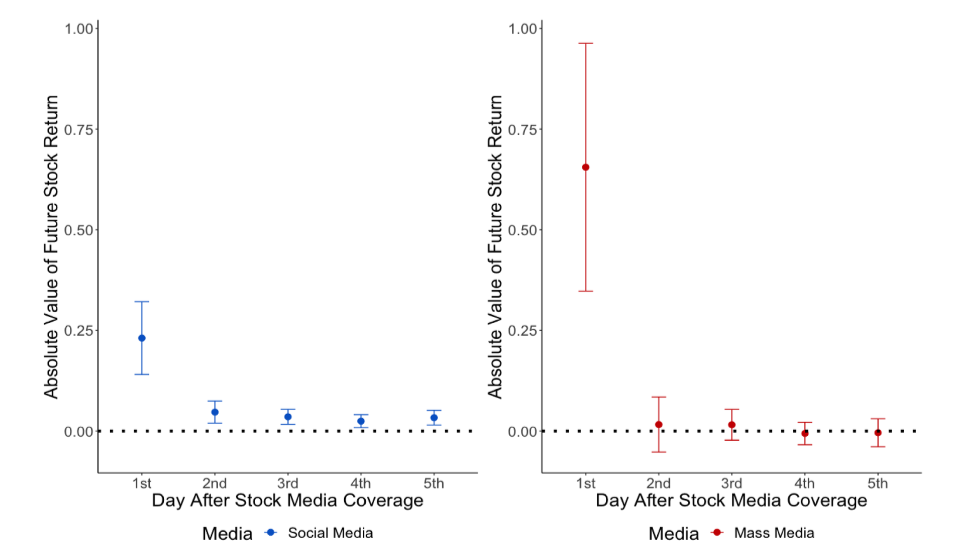

Is the social media filter good or bad for individual investors? If individual investors are able to read all the information on the stock market, with a more diverse information distribution, then mass media obviously provides a clearer big picture – and using social media could be considered bad. Yet, is it really possible to read all the information? Attention and time are scarce for investors. They can only read part of the information. Thus, the question must be different: when a stock has higher returns in the future, which channel provides more information now? Figure 2 (left: social media; right: mass media) shows the results. On day t+1, information in mass media is a better predictor than that on social media; Contrarily, on days t+2 to t+5, information in social media does a better job than that in mass media.

Figure 2: Comparison between the Predictive Power of Social Media Posts and that of Mass Media Reports (Left: social media; Right: mass media. Source: Dong et. al., 2022)

This interesting result suggests that social media and mass media serve different roles in diffusing information to stock market participators. Both work. We should not arbitrarily make assumptions that mass media is superior to social media.

Social media does not only serve as an information channel, but also monitors – often in real-time – companies and therefore plays a part in improving the information environment. People praise or criticize companies on social media. They may intentionally or unintentionally diffuse correct or incorrect information. However, the rumors already existed regardless of the post on social media. Social media simply makes them observable – if they are observable, then they can be confirmed or refuted. In fact, academic studies have found that companies are more likely to voluntarily issue announcements after being highlighted by social media posts. In this regard, social media improves the information environment in the financial markets.

There’s no easy answer. When deciding which information source to use, individual investors must consider the cost and the benefit of using that source. Social media provides cheaper and quicker access to information, but it is not perfect. But, then again, other information sources such as mass media are not perfect either. It’s simply that they predict future returns in different ways.

© IE Insights.