“When a product is free, the product is you.” This maxim has long been used to explain (and warn about) the business model of Google and YouTube (Alphabet), Facebook and Instagram (Meta), and the Chinese platform TikTok, among various other social networks, apps, and content services. These corporations offer their services “for free” in exchange for the user providing them with huge amounts of personal data, ranging from geolocation to shopping habits, not to mention health, state of mind, and personal beliefs.

But this is not even the full picture. In fact, a large part of the infrastructure needed to fuel these companies is also paid for by the user. Consumers do not only (willingly or unwittingly) hand over their data to these giants for subsequent monetization in the form of targeted advertising, they also pay for the fiber optic networks and antennas (via phone bills and cellphone top-ups) that are essential for the technological giants to do business. The same applies to streaming services such as Netflix and Spotify, which charge a monthly fee to access their content but are now venturing into the advertising business under the umbrella of “subscriptions with ads” – and this may very well mean that customers will be surrendering personal data.

The user pays twice: with their data and in their phone bill.

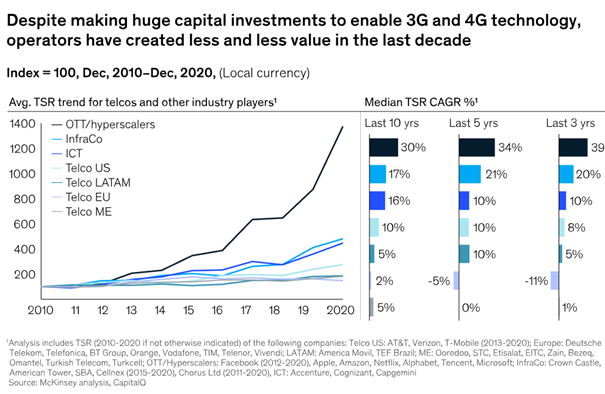

Twenty years ago, telecom operators were some of the biggest, most influential corporations in the world. This influence has waned over the years, and they have become mere middlemen that connect users with online service providers, despite efforts to add value to services (TV and streaming, cell phone insurance, CCTV). This explains, together with growing competition in the Internet access market, why many of these corporations have lost part of their stock market value over the last few decades and their profits have remained flat, compared to the explosive growth in turnover, profits, and influence of the big techs.

For years, the main telcos, especially European operators such as Orange, Telefónica, and D-Telekom, have been calling for the big techs to pay for part of the development of telecommunications networks. This change would go against the principle of net neutrality on which the Internet has been based since its inception and which is a central aspect in many digital companies’ business models.

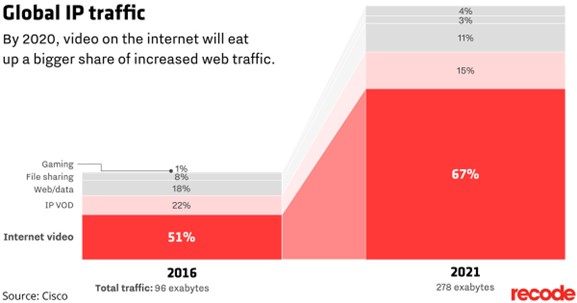

Every time Claro (Latam), Telefónica (Europe), Rogers Telecom (Canada), Barthi Airtel (India) and MTN (Africa) – just to name just a few of the world’s leading Internet Service Providers – expand their connection capacity with new infrastructure (cable, fiber, towers), half of these new “data pipes” are flooded with bytes from the likes of Netflix, TikTok, YouTube, and Instagram.

Almost all of these companies are from the United States and, to a growing extent, from China, and this factor is becoming more relevant in a geopolitical context. At the recent Mobile World Congress in Barcelona, Thierry Breton, the Commissioner for Internal Market and Services at the European Commission, stated “We will need to find a financing model for the huge investments needed that respects and preserves the fundamental elements of our European acquis: the freedom of choice of the end-user” and “the freedom of offering services on a fair, competitive level playing field.”

Source: An explosion of online video could triple bandwidth consumption again in the next five years – Vox

It may be necessary to balance the principle of “net neutrality” with the fact that the majority of Internet traffic is actually monopolized by a few companies, introducing the idea that the big techs should contribute financially to the maintenance, upgrading and expansion of these infrastructures. This is particularly true at a time when the development of web3, blockchain, 5G, 6G, and the metaverse will require millions of dollars in investments in any country that does not want to be left behind in the global digital economy race.

If the big techs, which generate most of the data flowing through cables and antennas, were to pay for part of the hardware, this could have a major impact on shaping digital business models. Traditional telcos would be able to invest more, boost revenues and profits, or do both. In turn, consumers could benefit from the deployment of higher-speed and higher-quality networks, see a reduction in their phone bills, or a combination of both. Part of this outlay would be passed on to the companies who would have to shoulder the cost through higher prices, increased efficiency, or lower profits.

Internet geopolitics: corporations that are more powerful than countries.

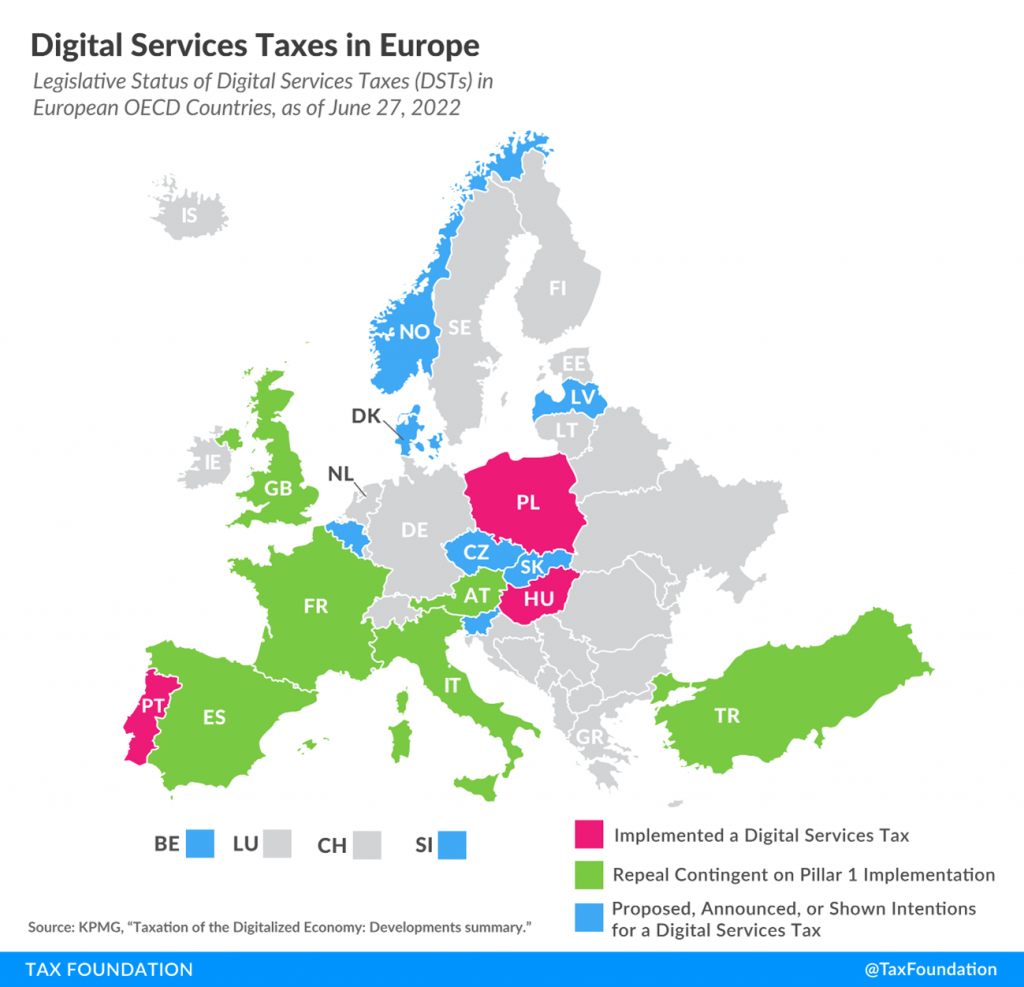

Tech titans are a major source of power for the countries where they are located and charging these corporations a toll for using the networks would mean generating tension with none other than the United States and China. This happened recently when some European countries such as Spain and France created a “Google tax” on the largest digital advertising services as a way to offset their tax practices of diverting part of their profits to countries with lower taxes. Trump outright rejected any measure that would harm the US digital giants and threatened to impose trade barriers on countries that pursued this strategy.

Only the global economic clout of the European Union can put this debate on the table. Not even the strongest of its members, such as Germany and France, would be able to do so on their own. However, it’s one thing to raise the topic and another to make it happen. Netflix’s CEO rejected European Commissioner Breton’s idea less than 24 hours after it was mooted.

And what does this have to do with Internet speed and economic development in Africa, Latin America, and Southeast Asia? Quite a lot, actually. No single country or government currently has the leverage on its own to make a case against companies like Bytedance, Netflix, and the GAFAM corporations. Each of these companies has a stock market valuation (and revenues) that exceed the GDP of most countries – and the integration systems in these regions do not currently have the authority or EU-like capacity to engage in a similar debate.

If the shift that the European Union apparently wants to promote does not materialize in some shape or form, telecommunications companies will continue to bear the full cost of modernizing digital infrastructures. This will mean slower deployment of new technologies, lower profits, and weaker investment by regional telecom operators, higher prices, and poorer connection quality for users, or a combination of all. In addition, it could encourage a growing digital divide between the least developed countries and digital powerhouses like the United States and China, though on a more moderate scale. And it just so happens that these two powers are also the main exporters of today’s digital services and content.

© IE Insights.