It is well acknowledged just how important “brand” is to the success of a business. But what might come as a surprise is that brand is even more important in driving purchase decisions made between businesses than it is for consumers buying a product. This is because, although B2B decision making is usually portrayed as more “rational” than B2C, B2B buyers have more at stake when deciding to work with one provider or another. The popular expression “nobody ever got fired for buying IBM” encapsulates why brand matters in B2B. Findings from academic literature published in the last fifteen years provide further evidence that emotions play a key role in B2B purchase decisions.

It is possible to measure the value of a brand. Brand value is usually referred to as “financial-based brand equity” and it represents the economic or monetary value of a brand. In other words, the estimated amount at which the brand would be bought or sold in the market between two willing, knowledgeable and unrelated parties. There is a broad myriad of methodologies to value brands. But in most of them, brand value or financial-based brand equity is considered to be a function of brand strength or consumer-based brand equity, which is traditionally defined as the set of associations, attitudes and behaviors that clients and potential clients have towards a brand. Brand strength is usually, a leading indicator of brand value.

In fact, recent data from the Brand Finance ranking shows that although the brands of B2Bs contribute less to firm value, they are still growing faster than B2C brands. While the average value of B2B brands in relation to the total value of the business, is lower than that of B2C brand (12% vs. 19%), the value of B2B brand grew by 16% between 2016 and 2020, against 9% of B2C. This may be affected in the next few years by the adjustments taking place in the technology sector.

Yet, despite all this evidence, B2B companies continue to invest less in their brand and marketing efforts than B2C companies do. The 2022 CMO Survey shows that, in the UK, B2B brands invest around 7% of their revenues in marketing, while B2C brands invest around 10%. Results are similar for the US, with B2B brands investing around 6-7% of their revenue in marketing, and B2Cs 7-15%. And not only do B2B companies underinvest in marketing, but the little they do put towards their brand, they tend to show lower investment consistency, with their campaigns using less channels and running for shorter periods than B2C’s campaigns. This is where B2B brands can learn from their B2C counterparts.

There are five myths about branding that are holding B2B brands back:

Myth #1: B2B brands don’t need advertising.

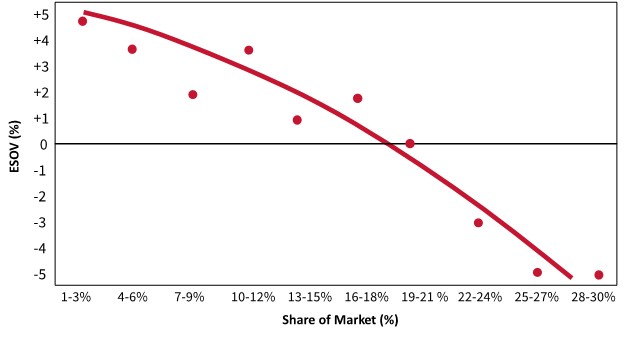

Even B2B brands grow by reach. A perfect example of this comes from Salesforce. The cloud-based software company has shown an impressive growth in the past 20 years by applying an old but interesting advertising theory – the Advertising Intensiveness Curve – from John Philip Jones who showed that larger shares of voice are associated with larger shares of market. He studied 1,096 advertised brands in 23 countries, classifying them in profit takers (those whose share of voice was the same or below their market shares) and investment brands (those whose share of voice was above their market shares). The difference between share of voice (SOV) and market share (SOM), it´s known as Excess Share of Voice (ESOV). He found that, in equilibrium, advertising worked harder for bigger brands and they could get away with lower ESOVs – and the opposite was true for smaller brands and new brands, which needed higher ESOVs to grow. Recent data from IPA confirms this also applies to B2B.

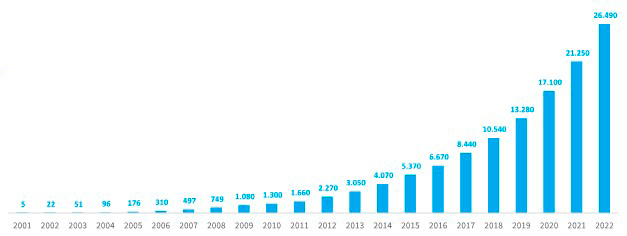

Salesforce’s revenues 2001-2022 ($m)

Source: Salesforce’s annual reviews 2005-2022

Curve Comparing Excess Share of Voice with Share of Market

Source: Adapted from Jones, J.P. (1990). Ad spending: maintaining market share. Harvard business review, 68 1, 38-42

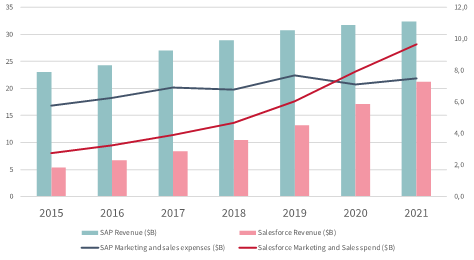

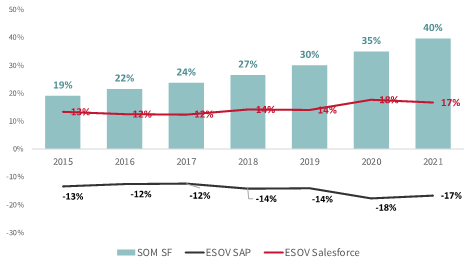

What Salesforce did was make sure its relative ESOV was higher than that of its direct competitor, SAP. By spending 45% of their revenues on sales and marketing, Saleforce consistently “stole” market share from SAP, who spends around 25% of its revenues on sales and marketing. As a consequence, in the period 2015-2021, SAP revenues grew 1,4x vs. Salesforce’s revenues that grew 4x. And while the ESOV of Salesforce continued to grow in the period, SAP decreased. As a consequence, Salesforce doubled its market share. The lesson we can learn from Salesforce is that advertising investment and broad reach communications that increase SOV will help grow the business, in B2B just as it does in B2C. (Note this is prior to Salesforce’s layoffs.)

SAP vs. Salesforce revenues and marketing expenses (2015-2021)

Source: Developed by author based on SAP and Salesforce’s annual reviews data

Relative ESOV SAP vs. Salesforce (2015-2021)

Source: Developed by author based on SAP and Salesforce’s annual reviews data

Myth #2: B2B is more about relationship building than brand building.

As Saber Sherrard, Rishi Dave, and Mollie Parker MacGregor explain in Harvard Business Review, “90% of buyers choose a brand they already have in mind at the beginning of the sales process.” It’s key to be part of the “consideration set” – and consideration is achieved mainly through broad reach. Several academic studies confirm this fact. For example, Wilkinson, Trinh, Lee and Brown showed that 60% of the sales of a plastic B2B brand came from 80% of its less loyal clients. In the same line, Bennett confirmed that airlines bought planes from suppliers like Boeing, Airbus or Embraer in line with their size, and therefore all of these providers actually share customers. What these two studies prove is that the smaller a brand is, the less loyal clients it has so, in order to grow, companies need to “steal” share from big brands and its focus should not be exclusively on loyal clients.

The main consequence of this myth is that B2B marketing is skewed towards more targeted media and loyalty objectives. However, strong B2B brands are built on a balance of broad reach and activation campaign and B2B marketers must shift this balance towards more broadly targeted campaigns and away from exclusively focusing on loyalty.

What are the B2B brands that comes most easily to mind? It is likely the ones that are heavily invested in brand building – such as Accenture, IBM or Salesforce. Whether it is through sponsorships or multichannel campaigns, these brands have consistently invested in broad reach communications.

Myth #3: Emotions don’t matter in B2B.

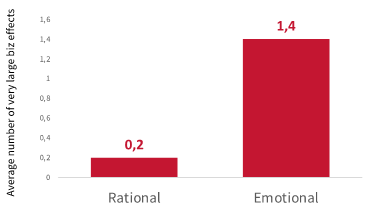

Most executives assume emotions don’t matter in B2B. The reality is quite the opposite – in fact, B2B customers are often more emotionally attached than B2C clients. A study conducted by Google and CEB show that the degree of risk assumed by a B2B buyer explains this higher emotional connection. A B2B buyer risks his credibility and reputation within his job if he makes the wrong decision. This is why, these executives gravitate towards safe bets, brands they can really trust. As Daniel Baack, Rick Wilson, Maria van Dessel and Charles Patti show, creative messaging in B2B is more effective than rational messaging in driving attitudinal and behavioral responses in B2B buyers. Recent to data from IPA, emotional campaigns outperform rational ones in B2B.

Emotional campaigns outperform rational campaigns in B2B.

Source: IPA Databank 1998-2019 B2B cases

Myth #4: Distinctiveness and consistency are not as important to build B2B brands

It is not only the use of emotion that can improve the effectiveness of a communication campaign in B2B, but the consistent use of codes (distinctive brand colors, shapes, and sound) also contributes to communication effectiveness. According to data from the LinkedIn B2B Institute and System 1, 75% of the B2B ads are ineffective and don´t drive long-term growth. The B2B brands that have grown the most in their category are the ones that have mastered the consistent use of their codes: the green dot of Deloitte, the stylized a of Aramco, and the Astro mascot of Salesforce.

What we can learn from these brands is that the consistent use of distinctive brand assets increase consideration and communications effectiveness, because people can quickly identify the brand behind the ad without having to think too much. Several authors prove that brands that embrace a consistent distinctive identity in B2B markets have the potential to positively influence buyer responses.

Myth #5: We know our clients, we do not need research.

Even the most worthy B2B executives tend to think that they know their clients and therefore need no research. I call this trap, “MBO”, managing by opinion. It is lack of market orientation dressed up as client intimate knowledge. It is very common in B2B circles because it is an environment in which clients are known by name, and the same goes for their families, and their business evolution. But it is rare to have the information about all the relevant influencers involved in the decision making process, and harder still to know those potential clients that don’t want to work with you and why that is so. According to Allison+Partners, 45% of B2B marketing decision makers have not conducted any primary research focused on their customers’ needs and challenges in the last 12 months. If you don’t ask your clients, you will be oblivious to their changing opinions, attitudes, and behaviors and you therefore won’t be able to respond adequately. B2B marketing has become, in many industries, the art of managing in the dark, based on just the easy-to-get data.

Effectively managing your B2B brand

Brand is a key purchase factor in B2B and B2B brands grow exactly in the same way as B2C: with broad reach (not purely building relationships), supported by the consistent use of emotions and distinctive codes. B2B clients are humans, not machines, so it’s important to pursue emotional messages and go after broader reach media. Above all, though, it is essential to measure and track key brand metrics (like salience, penetration or loyalty), in order to optimize B2B brand management – not to mention defend your budgets and justify those long-term effects.

© IE Insights.