Federal Reserve Governor Christopher J. Waller addresses climate change risks and financial stability at IE University

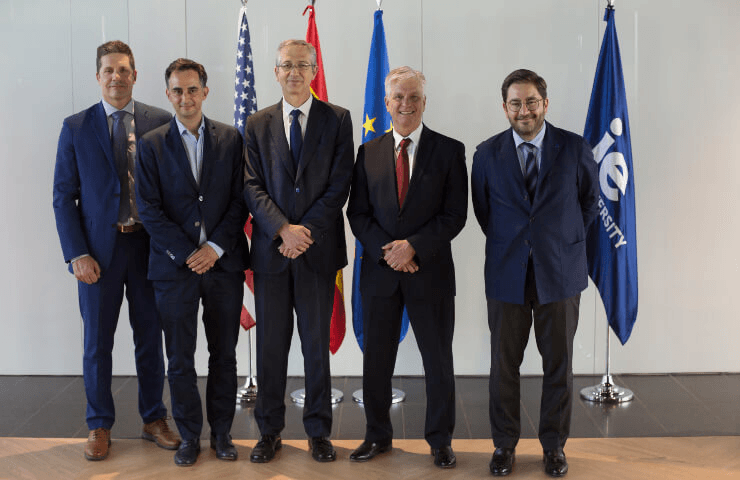

Federal Reserve (Fed) Governor Christopher J. Waller and Governor of the Bank of Spain, Pablo Hernández de Cos, joined Manuel Muñiz, Dean of IE School of Politics, Economics and Global Affairs, and IE University faculty and students to discuss current challenges in Economics and Finance.

In a vivid conference hosted at IE Tower - the new vertical, technological and sustainable campus of IE University in Madrid - Governor Waller spoke on climate change and highlighted that, while he has no doubts that it is real, his focus is on financial stability. In his opinion, climate change does not represent a serious risk to the financial stability of the United States. “Climate change is real, but I do not believe it poses a serious risk to the safety and soundness of large banks or the financial stability of the United States”, he stated.

“Risks are risks. There is no need for us to focus on one set of risks in a way that crowds out our focus on others”, he continued, emphasizing the importance of prioritizing risks based on evidence and analysis, focusing on more immediate and material risks aligned with the Fed's mandate.

As Governor Waller explained to a large audience, the Federal Reserve's mission is to promote financial stability and avoid banking crises.

“My role as a Fed Governor is to focus on financial risks, assessing whether climate-related risks are distinct enough from other risks to warrant special treatment.”

Federal Reserve Governor Christopher J. Waller

Governor Waller stressed the importance of promoting academic research to study the role that climate plays in economic outcomes.

Manuel Muñiz, Dean of IE School of Politics, Economics and Global Affairs and Provost of IE University’s kicked off this conference by reflecting on the ongoing macro trends in the global economic and geopolitical landscape. Current events, he said, are as pivotal now as they were at the end of the Cold War. "We are living through a tumultuous time for the global economy. Whether it's the effects of the Covid 19 pandemic, to the impact of the war in Ukraine, to supply chain challenges to the return of high inflation to advanced economies, we can say we are in uncharted waters”, he stated.

“It is more important than ever that we convene discussions that bridge academia and the world of practice and that explore the interconnections between politics, geopolitics and economics.”

Manuel Muñiz, Dean of IE School of Politics, Economics and Global Affairs and Provost of IE University

Governor Hernández de Cos gave a European view of changing macroeconomic and geopolitical conditions. He warned that some economic developments within the European Union (EU) have gone in the right direction, but others have not. While praising regulatory reforms in the EU that have kept banks healthy, he urged those banks to have contingency plans in place for rising interest rates, pointing out that we have not yet seen the full impact of rising rates. He also stressed that the Spanish banking system is solid and well prepared for the new challenges.

Risk-management practices, he asserted, must reflect the real risks that firms might face, such as liquidity risks. He also mentioned climate change risks and cyber risks.

“In light of events like the war in Ukraine, protections against cyber risks are one of our utmost priorities.”

Governor of the Bank of Spain, Pablo Hernández de Cos