- Home

- The Sun Is Brighter In The Mena Region

The sun is brighter in the MENA region

The energy world has been marked by processes of change throughout history. Considered a source of power for an isolated global configuration, today it is becoming one of the main drivers to improve regional integration, particularly in the Middle East and North of Africa (MENA).

Traditional vs renewable sources

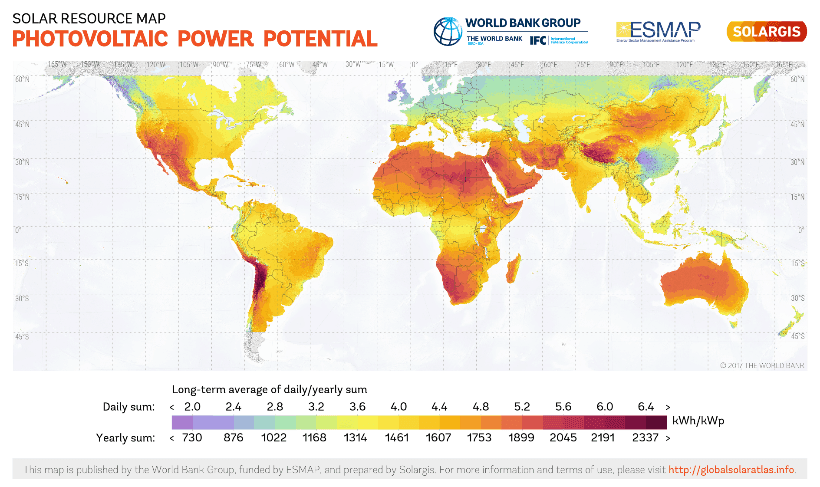

Source: Map prepared by Solargis for The World Bank.

Source: Map prepared by Solargis for The World Bank.More information

For many years, the global supply of oil and coal -traditional sources of energy production- have been in the hands of a few countries. In the case of oil, 96 percent of the reserves are concentrated in only 20 countries, mostly located in the MENA region, specifically in Saudi Arabia, Iran, Iraq, United Arab Emirates, and Libya. However, Morocco, Jordan, Lebanon, and Yemen -countries without oil potential- represent the highest photovoltaic power potential in the world (Figure 1). In the near future, renewables´ potential in the region, mainly solar and wind power, will likely result in the economies with the lowest oil reserves becoming the leading powers in energy.

Promotion of renewables in the MENA region

In order to take advantage of the clean energy potential in the region, political leaders have already been working on several initiatives. One of those is The Regional Center for Renewable Energy and Energy Efficiency (RCREEE), an intergovernmental organization that seeks energy transition by promoting policy dialogs and strategies to support the Arab states in the process. Another includes Dii-Desert Energy, a German industrial initiative focused on identifying potential locations in desert areas for future projects. There also is the Pan-Arab Renewable Energy Strategy 2030, a study developed by the International Renewable Energy Agency (IRENA) and supported by the League Arab of Nations. The report proposes recommendations to strengthen institutional and legal frameworks, as well as technology and market access requirements for clean energy industry in the next years.

Tarfaya wind farm, Morocco. Courtesy of ENGIE

Tarfaya wind farm, Morocco. Courtesy of ENGIEIn this context, the Pan-American Strategy reflects some of the commitments assumed by the Arab countries for 2020 and 2030. Although in this document most countries have shown solid interest in increasing the percentage of renewables, both in installed capacity and in power generation, some of them remain reluctant to give bigger steps. For example, by 2020, Morocco proposes to have 42 percent of installed capacity in renewables; in contrast, UAE offers only 1 percent in Dubai.

In regard to power generation, Egypt leads the region's goal with the production of 20 percent of its energy with renewables, and in smaller quantities, Algeria with 5 percent, and Kuwait with 6 percent. However, the scenario looks more promising for the goals proposed for 2030. Algeria increased its target, visualizing 40 percent of renewables in power-generation, as well as Saudi Arabia and Tunisia with 30 percent each. The investment of these countries, for the next ten years, is reflected mainly in solar – photovoltaic and thermal- and wind farms, with a smaller proportion in biogas, hydro, geothermal and biomass.

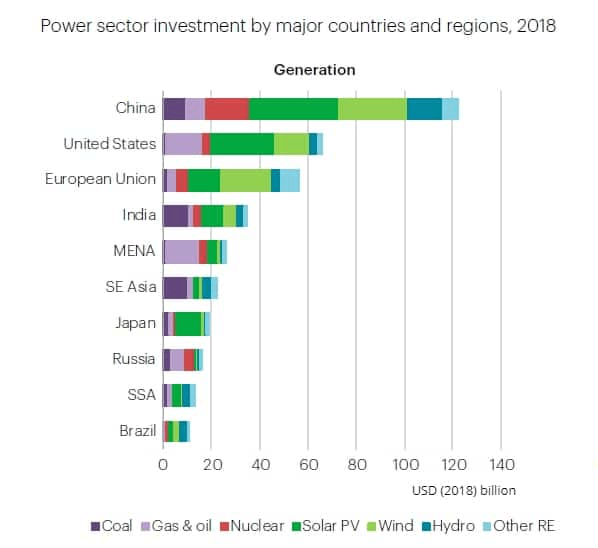

Source: World Energy Investment 2019

Source: World Energy Investment 2019The result of numerous actions and strategies that have been implemented are already generating positives changes. In 2015, the production of renewables in the Arab region grew by 150 percent compared to 2012. In other words, it went from producing 1.2 gigawatts to exceeding 3.0 GW. Although this number still represents only 6 percent of the total capacity, it is expected that by 2030 it will increase significantly. Despite the positive facts, the World Energy Investment 2019 report pointed out that in 2018 MENA region investment in fossil fuels was higher than renewables, in contrast with renewable investment in China and the United States (Figure 1). Other regions in the world, also located in the Sunbelt, must not lose sight. By 2030, solar- photovoltaic energy will turn India, Latin America, and Southeast Asia in important players.

The side-industry

The natural resources are only half of the way of the energy transformation, while innovation and side manufacturing are essential to fulfill the other half. Innovation in technology has made the prices of renewables more affordable and competitive in the market. According to the IRENA, today the cost of a photovoltaic solar module is 80 percent less expensive than at the end of 2009, while the prices of wind turbines have decreased their price by 30-40 percent.

The important thing here is the deployment of technology to have more efficient developments. High-tech products related to energy efficiency and massification of renewables are generating demand for new minerals. In an article published in 2019 by Stratfor, the so-called "rare earth elements" such as Europium and Neodymium, are taking great relevance in both economics and geopolitics. These new minerals are used in small quantities and generally for disruptive technologies, such as wind turbines, efficient electric light bulbs, LCD and plasma displays, hybrid vehicles, rechargeable batteries, and even defense missiles, to name a few. The elements are key for energy transition and electric mobility. In the geopolitical scope, only a few countries in the world have access to bigger quantities of those elements: China (55 million tons), Russia (19 million tons), the United States (13 million tons), India (3.1 million tons), Australia (1.6 million tons) and Brazil (0.05 million tons).

Current situation in the MENA region

Through a classic SWOT analysis will be pointed out the main strength, weakness, opportunities, and threats of the MENA region regarding the clean energy developing market.

- One major strength is the natural resources, which put the region, once again in a privileged position in this endeavor.

- However, the major weakness of MENA is the strong dependency on fossil fuels as the main source of public revenue for some countries in the region.

- The main opportunity is the ability for MENA to use this endeavor as a means to strengthen its relationships with other neighboring economies. This would better ensure steady energy supply, economies of scale and joint investment.

- Finally, the main threat that MENA region faces is China, a global player in the renewable energy industry and one of the world's leading producers and consumers of energy, solar panels, and electric cars.

In conclusion, to achieve a fully developed clean energy market is not enough having natural resources. A complex ecosystem is must need to transform non-tradable common goods, such as sun or wind, into tradable products. Part of the components of that ecosystem, besides the natural resources, is technological innovation, and new legal and political frameworks. Some of these components are already taking a leading role in countries’ societies and industries, which is precisely why regional integration will be key. In the coming years, the challenge for the countries located in the MENA region will be to collaborate to complement each other’s strengths better, and to both consolidate their competitive advantages and leverage internal market opportunities. If the countries in the MENA region play their cards well, it is very likely that the sun will shine brighter in Arab lands.

About the author

Andrea Serrudo is a Master’s student pursuing her International Relations degree. As a business sustainability professional, Andrea has 10+ years of experience in public affairs, sustainable development, and strategic communications in both the public and private sector. Find her on LinkedIn here.